From 100PercentFedUp - READ ORIGINAL

Some media, including videos, may only be available to view at the original.

Well, folks, as “Bidenomics” tightens its grip on the American economy, keep an eye on the banks.

Turns out, the latest FDIC report just dropped a bombshell.

Turns out unrealized losses on investment securities for banks are now at a whopping $517 billion.

What’s driving this?

Some of the blame could be due to mortgage-backed securities taking a hit.

This now marks the 10th straight quarter of unrealized losses.

This beats the infamous 2008 Financial Crisis.

The latest report from the FDIC shows shows unrealized losses on held-to-maturity and available-for-sale securities, totaling $516.5 billion, up $38.9 billion from the previous quarter. Now compare to 2008-2009 crisis

.

LMAO pic.twitter.com/Ltvn8W7LE9

— Gertrude McCrackin 2.0 — Ken Conklin (@DocnotDoctor76) June 4, 2024

BREAKING: U.S. Banking System

FDIC warns that 63 Lenders are on the brink of insolvency due to banks sitting on $517 billion in unrealized losses pic.twitter.com/XReQWwNIV5

— Carl ₿ MENGER

(@CarlBMenger) June 4, 2024

BREAKING: 63 AMERICAN BANKS ARE ON THE BRINK OF INSOLVENT COLLAPSE ACCORDING TO THE #FDIC

“Know What You Hold!!!” pic.twitter.com/H68wW21kj0

— Echo 𝕏 (@echodatruth) June 4, 2024

The Daily Hodl reports:

Unrealized losses in the US banking system are once again on the rise, according to new numbers from the Federal Deposit Insurance Corporation (FDIC).

In its Quarterly Banking Profile report, the FDIC says banks are now saddled with more than half a trillion dollars in paper losses on their balance sheets, due largely to exposure to the residential real estate market.

Unrealized losses represent the difference between the price banks paid for securities and the current market value of those assets.

Although banks can hold securities until they mature without marking them to market on their balance sheets, unrealized losses can become an extreme liability when banks need liquidity.

The FDIC’s own report:

The banking industry continued to show resilience in the first quarter. Net income rebounded from the non-recurring expenses that affected earnings last quarter, asset quality metrics remained generally favorable, and the industry’s liquidity was stable. However, the industry’s net interest margin declined as competition continued to pressure rates paid on deposits and asset yields declined.

The banking industry’s net income of $64.2 billion in the first quarter was an increase of 79.5 percent from the prior quarter, mainly due to lower expense related to the FDIC special assessment and lower goodwill write downs. Otherwise, net income in the first quarter would have increased 14.3 percent from the prior quarter as higher non-interest income and lower provision expenses more than offset a decline in net interest income.

Community banks reported net income of $6.3 billion, a quarterly increase of 6.1 percent, driven by better results on the sale of securities and lower non-interest and provision expenses.

The industry’s net interest margin declined by 10 basis points to 3.17 percent, below the pre-pandemic average of 3.25 percent. Continued deposit competition caused funding costs to increase during the quarter while the yield on earning assets declined. The net interest margin for community banks also declined in the first quarter and remains below its pre-pandemic average.

Unrealized losses on available-for-sale and held-to-maturity securities increased by $39 billion to $517 billion in the first quarter. Higher unrealized losses on residential mortgage-backed securities, resulting from higher mortgage rates in the first quarter, drove the overall increase. This is the ninth straight quarter of unusually high unrealized losses since the Federal Reserve began to raise interest rates in first quarter 2022.

The industry’s total loans declined by $35 billion, or 0.3 percent, in the first quarter. Most of the decline was reported by the largest banks, in line with a seasonal decline in credit card loans and lower auto loan balances. The industry’s year-over-year loan growth rate of 1.7 percent, the slowest rate of annual growth since third quarter 2021, has steadily declined over the past year. The annual increase was led by credit card loans and CRE loans. Loan growth at community banks was more robust, increasing 0.9 percent from the prior quarter and 7.1 percent from the prior year, led by CRE and residential mortgage loans.

Asset quality metrics were generally favorable with the exception of material deterioration in CRE and credit card portfolios. The industry’s noncurrent rate increased five basis points from the prior quarter to 0.91 percent, a level still well below the pre-pandemic average noncurrent rate of 1.28 percent.

The increase in non-current loan balances continued among non-owner occupied CRE loans, driven by office loans at the largest banks, those with assets greater than $250 billion. The next tier of banks, those with total assets between $10 billion and $250 billion in assets, is also showing some stress in non-owner occupied CRE loans. Weak demand for office space is softening property values, and higher interest rates are affecting the credit quality and refinancing ability of office and other types of CRE loans. As a result, the noncurrent rate for non-owner occupied CRE loans is now at its highest level since fourth quarter 2013.

Driven by write-downs on credit cards, the industry’s quarterly net charge-off rate remained at 0.65 percent for the second straight quarter, 24 basis points higher than the prior year’s rate. The current net charge-off rate is 17 basis points higher than the pre-pandemic average. The credit card net charge-off rate was the highest rate since third quarter 2011.

Domestic deposits increased for a second consecutive quarter, this quarter by $191 billion, driven by growth in transaction accounts. The shift away from non-interest-bearing deposits toward interest-bearing deposits continued, as interest-bearing deposits increased 1.7 percent quarter over quarter and non-interest-bearing deposits declined for the eighth consecutive quarter. Estimated uninsured deposits increased $63 billion in the quarter, representing the first reported increase since fourth quarter 2021.

The number of banks on the Problem Bank List, those with a CAMELS composite rating of “4” or “5,” increased from 52 in fourth quarter 2023 to 63 in first quarter 2024. The number of problem banks represented 1.4 percent of total banks, which was within the normal range for non-crisis periods of one to two percent of all banks. Total assets held by problem banks increased $15.8 billion to $82.1 billion during the quarter.

The Deposit Insurance Fund (DIF) balance was $125.3 billion on March 31, up $3.5 billion from the end of the fourth quarter. Insured deposits increased by 1.1 percent, about half of typical growth in the first quarter. The reserve ratio, or the fund balance relative to insured deposits, increased by two basis points to 1.17 percent. The reserve ratio currently remains on track to reach the 1.35 percent minimum reserve ratio by the statutory deadline of September 30, 2028.

And let’s not forget, the CEO of the FDIC, Martin Gruenberg, is stepping down:

Republicans on the House Financial Services Committee laid into FDIC chairman Martin Gruenberg over a report that revealed widespread sexual harassment at the agency, badgering the Democrat to resign. https://t.co/pS73rxPosR

— Drogon (@drogon_dracarys) June 3, 2024

This is in direct alignment with a story we brought you earlier this week:

A Top 4 Bank JUST Freaked Out — “Major WARNING”

Major Warning!

No, that’s not my words, those words come from Kevin Paffrath, better known as “MeetKevin” on YouTube where he has nearly 2 million followers.

Why?

Because people care what he has to say and he’s often not just right but accurate in predicting the trends that are soon about to hit us in the economy.

Kevin has historically been mostly bullish on the U.S. economy, so when I see him post concerns it especially catches my attention.

And here’s what he just posted this morning:

Let me explain more….

Here’s a quick summary of what Citibank just posted, all of which is very bad news for the U.S. economy and quite frankly lines up perfectly with what we’ve been warning you about for the past few months:

WOW

Citibank

The cycle is finally turning

The tailwinds to consumer spending have faded

200bp of cuts are coming this year

Credit card delinquencies highest since 2007, by some measures

Goods spending in contraction

And more. Video tomorrow… sh9t.

— Meet Kevin

(@realMeetKevin) June 5, 2024

Even more here, from eHack:

For two years, the US economy has been resilient, defying forecasts for a slowdown. However, the cycle finally appears to be turning. A pullback in consumer spending, slowing core inflation (as pricing power rapidly dissipates), and a projected significant softening in labor markets led Citi to project the first Fed rate cut in July, with cuts at each subsequent meeting through June 2025 (totaling 200 basis points).

I’m surprised they agree with Standard Chartered on the first cut coming in July. Most banks are taking the September approach.

The market is currently pricing in fewer than two cuts for the year.

Many banks have different opinions about this. I agree with Standard Chartered’s projection of three cuts this year, starting in July, due to softening economic data. Most other banks are forecasting two cuts.

The consumer is STRESSED. Here is some data to support this:

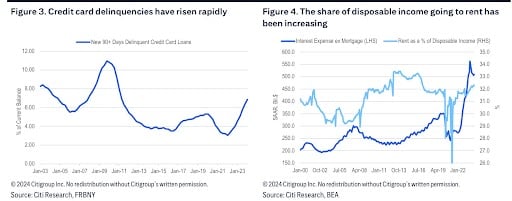

The tailwinds to consumer spending have faded, especially for lower-income and lower-net-worth individuals. Credit card delinquency rates are, by some measures, the highest since 2007, and the share of income going to interest expense and rent has increased rapidly.

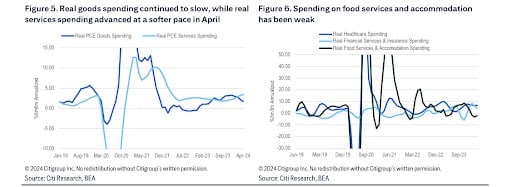

Goods spending is now contracting again, and food service spending is also declining. This impacts restaurants and companies like DoorDash.

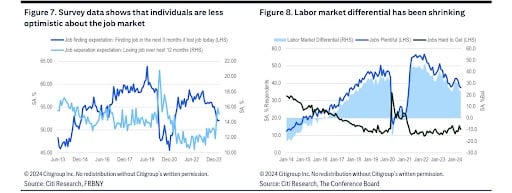

Consumer spending will pull back more sharply if the labor market weakens further. There are already signs in survey data that individuals are becoming more concerned about losing their jobs and the possibility of finding a new one.

Forward-looking indicators suggest the labor market will soften further. See below.

UPCOMING CATALYST:

The May unemployment rate in the employment report may turn out to be a very important catalyst. Citi expects an increase in the unemployment rate to 4.0% in May, driven by weak hiring in sectors like leisure and hospitality and construction.

We have seen this in earnings calls from single-family developers. They have stated that, on average, construction is taking 25% longer than it did pre-2019 due to construction labor shortages aimed at keeping labor costs down.

The other big issue is the Banks not marking their losses to market.

In simple explanation, most banks have incurred massive losses with the rising interest rates but they haven’t had to disclose those yet based on accounting rules.

So everyone knows the massive losses are there but they just haven’t been “realized” yet.

Some estimate the unrealized losses are as high as HALF A TRILLION:

JUST IN:

63 U.S. banks on brink of collapse with $517 billion losses – FDIC pic.twitter.com/RrIy1fipm0

— Radar

(@RadarHits) June 4, 2024

The crash is coming folks, and once it hits there will no longer be any time to prepare.

It will likely happen over a weekend too.

At that point it will be too late to get your money out of the banks. (just my opinion)

RELATED REPORT:

SPECIAL ALERT: Here Come Bank “Bail-Ins”!

WARNING! WARNING!

You’ve heard of bank bailouts.

We all learned about those back in 2008/09.

And last weekend.

But there’s something new they’re going to roll out this time around….Bank Bail-INS.

Why bail out a bank with money from Congress if you can just take the money right out of your existing bank account!

Gee, what a novel concept!

In other words, this:

The 2010 Obama-era Dodd-Frank Act, claims to ‘PROTECT’ your money by allowing banks to STEAL it through a process called ‘bank bail-ins’.

Unfortunately, it looks like we might all become EXPERTS on this in the weeks to come. pic.twitter.com/LoiTDRZ9Yy

— Epstein’s Sheet.

(@meantweeting1) March 11, 2023

That’s a funny clip, but this is no laughing matter.

This is very real.

And once again I’m warning you that it’s coming before it happens….so maybe you can protect yourself!

It’s not just me and my crazy ideas….here is one of the top financial YouTubers, Meet Kevin, talking about it:

And my man, Patrick Bet David too from just a few days ago:

Now check this out….

Video has leaked from closed door Fed meetings where they talk about how they can’t possibly warn the public (i.e. we can’t tell the public the truth!) because it will lead to mass hysteria.

Stunning.

They won’t tell you the truth, but we will.

Watch this:

HOLY CRAP!

FDIC Bankers Discuss ‘Bail-Ins’, Bank Runs & Market Collapse

They’re talking about financial crisis and their lack of faith in our banking system and how to keep the public from freaking out.

“I completely agree…you can’t tell the public about this, they would… pic.twitter.com/0dSFYQYWVT

— DailyNoah.com (@DailyNoahNews) March 19, 2023

More here:

FDIC Bankers Discuss ‘Bail-Ins’, Bank Runs & Market Collapse

They’re talking about financial crisis and their lack of faith in our banking system and how to keep the public from freaking out.

“You don’t want a huge run on the institutions, and, and they’re going to be… (

) pic.twitter.com/K8yaM8jzta

— Angelus caelis

(@caelisangelus) March 11, 2023

Why Bank Bail-Ins will be the new bailouts:

https://twitter.com/VersanAljarrah/status/1616842617026658305

It’s coming:

Body Language: FDIC Bank BAIL-INs pic.twitter.com/6IFodaGy5D

— ʙᴏᴍʙᴀʀᴅꜱ

(@BombardsBL) December 30, 2022

ChatGPT knows EXACTLY what they are:

Bank bail-ins are a method of resolving a failing bank’s financial difficulties by requiring the bank’s shareholders and creditors to contribute to the bank’s recapitalization, rather than relying solely on taxpayer funds. In a bail-in, the bank’s creditors, including bondholders and depositors with balances over a certain threshold, may have a portion of their holdings converted into equity in the bank or written off completely.

This approach is intended to protect taxpayers from having to bail out a failing bank, and instead puts the burden on the bank’s investors and creditors to bear the losses. Bail-ins are generally seen as a way to increase the accountability of banks and their investors, and to create incentives for banks to operate more prudently and manage risks more effectively.

Bail-ins have been implemented in various countries as part of financial regulatory reform efforts following the global financial crisis of 2008-2009. The European Union, for example, introduced a bail-in framework in 2014 that requires failing banks to first use their own funds and resources to address their financial difficulties before seeking public support.

Translation of that bold part: say you had $100,000 in a bank account.

One day they just decide a “bail in” is necessary and now you have $50,000. Or $25,000.

But they will thank you for doing your patriotic duty!

Wow, not me folks!

No way.

I’m going Crypto and Gold & Silver.

That’s just me, but I like my money where the thieves can’t just take it!

Here’s more:

Everything you need to know about bank bail-ins. Convenient timing considering what’s happening at #Silvergate $SI pic.twitter.com/qrmvfREIDN

— Nobody Special (@JG_Nuke) March 2, 2023

Of course the Government is telling you NOT to withdraw your funds….they’re safe!

“Don’t withdraw your money from the bank” The countdown to bank bail-ins just began. https://t.co/M4P1co2y9N

— Erik Voorhees (@ErikVoorhees) March 24, 2020

Look, I can’t tell you what to do, I’m not a financial advisor.

But me personally?

I have a big chunk of my assets in crypto and another big chunk in precious metals.

I keep as little as possible in the banks.

That’s just what helps me sleep best at night.

Here’s more on gold:

Here’s Why Central Banks Are Buying All the Gold They Can — And What YOU Can Do!

For the last year, central banks across the globe have been buying up as much gold (and often silver) as they can acquire without raising alarm bells. Now, we see why.

The recent bank runs and ongoing collapse of the U.S. banking system was anticipated by the “elites” and the central bankers who run things behind the scenes. They saw it coming and knew the best way to protect their assets was through physical precious metals.

If you’ve been waiting for me to bring you a solution about what YOU can do to protect yourself and you’re family, I’m happy to introduce you to something I absolutely love!

Precious metals.

I just talked about precious metals this week with Bo Polny and now I’m bringing you a solution that you can utilize right away if you’re so inclined…

A faith-driven, conservative precious metals company is currently helping Americans tap into the rising precious metals market through self-directed IRAs backed by physical precious metals. And while this service is not unique to Genesis, their adherence to Biblical stewardship of money makes them singularly qualified to receive a sponsored recommendation from this site.

Unlike most companies offering similar services, Genesis deals only with physical precious metals. They do not offer “virtual” or “paper” gold or silver.

With Genesis and their depositories, customers can see and touch the precious metals that back their retirement accounts. When it comes time to take distributions, Genesis customers can cash in some or all of their precious metals or have them delivered to their door.

Central bankers aren’t slowing down. In fact, nations like China and even U.S. states like Tennessee are quickly but quietly buying up gold to back their own treasuries. When the writing on the wall is this clear, it’s understandable why these governments are moving quickly to get ahead of any potential economic catastrophes in store.

Working with Genesis is the best way our readers can explore the physical precious metals market through self-directed IRAs. It benefits us as well when our readers work with this America-First company.

Visit genesiswlt.com or call 866-292-0443 today.

Don’t wait too long, we might have more bank failures right around the corner.

You know what has NEVER “failed”?

Gold. Precious metals. Indestructible.

There’s a reason they call it “God’s money”.

Watch this for more: